This program’s target is directed towards for-profit emergency and non-emergency medical ambulance companies* operating Type I, Type II, or Type III, with some flexibility towards Ambulettes or passenger/wheelchair vans used for paratransit if less than 20% of total operations. Our unique product creates a stable, long term market that is sensitive to real variance in risk which enables us to offer competitive pricing. We have the ability to offer a full package in a single product.

*Accounts operating exclusively as non-emergency paratransit/wheelchair vans are not eligible.

COMMERCIAL AUTOMOBILE

- Auto Liability: $1,000,000 CSL

- UM/UIM: State specific limits

- Med Pay: $10,000

- PIP: Statutory

- Physical Damage: $175,000/vehicle and $5,000,000 total fleet value

GENERAL LIABILITY

- $1,000,000 per occurrence/$3,000,000 annual aggregate

- Fire Legal: $500,000

- Med Pay: $10,000

- Incidental exposure to schools/classrooms including First Aid classes

- Medical directors when written as part of a service company

- Incidental lessors risk properties

- Incidental auto repair services for others

- GKLL: $1,000,000 max per location

- EPLI coverage available

- Abuse/molestation coverage

INLAND MARINE

- Miscellaneous medical service equipment including defibrillators, radios, EKG’s, respirators, monitors, gurneys, and stretchers

- Support equipment including ATV’s, bariatric lifts, portable boats, and powered cots

- Tools used for vehicle and equipment maintenance

MEDICAL MALPRACTICE

- Limits up to $1,000,000 per occurrence/$3,000,000 annual aggregate

PROPERTY

- Building, Business, Personal Property, and Business Income coverages

- Buildings over 20 years old need current updates to wiring, HVAC, plumbing, and roof

CYBER LIABILITY AND DATA BREACH RESPONSE

- Information Security & Privacy Liability – aggregate limits up to $1,000,000

- Privacy Breach Response Service – limits up to $500,000

EXCESS

- Follow Form Excess

- Options up to $5,000,000 occurrence/annual aggregate over Auto, General Liability, Professional Liability, and Employer’s Liability (no coverage over Abusive Acts Liability)

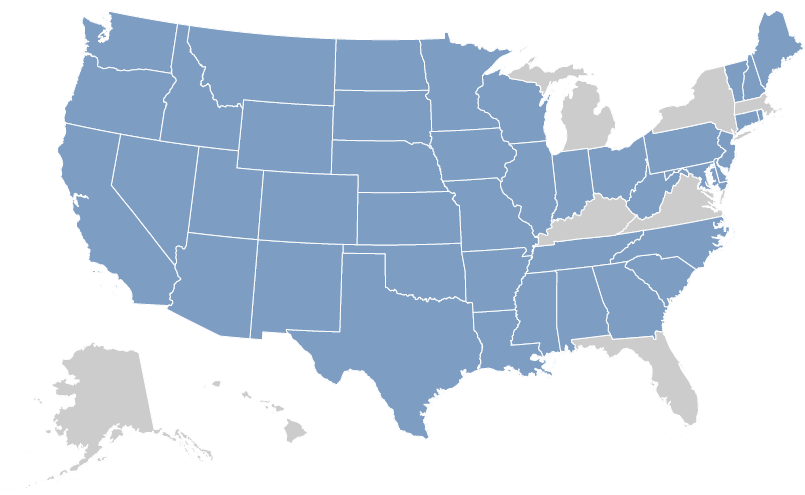

All except: AK, FL, HI, KY, MA, MI, NY, and VA

- First response/paramedics operating as independent contractors and not affiliated with a fire department, hospital, or municipal entity

- For profit ambulance companies

- Service Vehicles associated with commercial operations

- Private Passenger type vehicles owned by a Corp, LLC, or partnership and used for business purposes

- Ambulettes or passenger vans used for paratransit if less than 20% of total operations

- Current valued loss runs for prior 4 years valued within 60 days of submission

- Current vehicle lists with year, make, VIN, value, passenger capacity and usage

- Drivers list to include date of hire and certifications and/or safety programs completed (where applicable)

- While MVRs are desired at time of quotation, they are not required. However, current dated MVRs will be needed prior to binding; ultimate pricing is dependent on review of actual MVRs.

- Inland marine schedule

- No longer charging for most midterm driver additions

**Drivers falling outside of acceptable driver guidelines may still be subject to additional premium charges and/or be subject to restrictions up to and including exclusion

Ambulance Renewals

- Current vehicle lists with year, make, VIN, value, passenger capacity and usage

- Drivers list to include date of hire and certifications and/or safety programs completed (where applicable)

- While MVRs are desired at time of quotation, they are not required. However, current dated MVRs will be needed prior to binding; ultimate pricing is dependent on review of actual MVRs.

- Inland marine schedule

- No longer charging for most midterm driver additions

**Drivers falling outside of acceptable driver guidelines may still be subject to additional premium charges and/or be subject to restrictions up to and including exclusion

Bellingham is always open to developing relationships with new retail partners. Does your agency fit? Ask yourself the following questions to find out:

• Are you looking for a long term stable product with an “A” rated admitted carrier?

• Do your agents know and understand their clients and the business being submitted?

• Do you do the research to be able to provide complete and accurate information on all risks?

• Is a better overall product more important to you than the cheapest price?

• Do you have a desire to work with knowledgeable and flexible underwriters instead of just a binding authority?

• Are you willing to collaborate with our underwriters to write business rather than just submitting risks for quoting?

• Is the majority of the business you target eligible for our program?

APPLICATIONS

Ambulance Supplemental App – updated Mar 2023

Ambulance Renewal Supplemental App – updated Mar 2023

FLYERS

Ambulance Flyer– Updated Nov 2022