This program targets the insurance needs of your local independent commercial vehicle repair facility. We can write local shops that focus primarily on commercial vehicles of the medium class and above including trailers, farm equipment, and contractors’ equipment. Our approach incorporates standard policy forms, flexible underwriting, quick turnaround time and the exemplary customer service that you have come to expect from us.

Body Work/Painting (Auto Painting is acceptable w/ a separate paint booth that is ventilated and self-contained)

Engine work

Hydraulic Work

Oil/Lube/Tune up

Brake Repair

Alignment/Steering/Front End Suspension

Windshield Replacement/Repair

-

- General Liability

- $1,000,000 Occurrence/$2,000,000 aggregate

- Auto Liability

- $1,000,000 AL

- $1,000,000 follow-form excess available

- Auto Physical Damage

- $250,000 per unit or combination – tractor + trailer (s)

- Garage Keepers Legal Liability

- $500,000 any one item or any one loss

- Inland Marine Equipment

- $150,000 any one item

- $500,000 any one policy

- General Liability

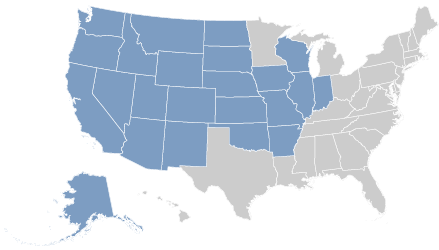

AK, AR, AZ, CA, CO, ID, IL, IN, IA, KS, MO, MT, ND, NE, NV, NM, OK, OR, SD, UT, WA, WI, WY

- BU Garage Liability Supplemental

- IFTA’s (if available)

- Current MVRs for all drivers

- Currently valued loss runs for the prior four years

- Any and all applicable supplemental coverage applications

Bellingham is always open to developing relationships with new retail partners. Does your agency fit? Ask yourself the following questions to find out:

• Are you looking for a long term stable product with an “A” rated admitted carrier?

• Do your agents know and understand their clients and the business being submitted?

• Do you do the research to be able to provide complete and accurate information on all risks?

• Is a better overall product more important to you than the cheapest price?

• Do you have a desire to work with knowledgeable and flexible underwriters instead of just a binding authority?

• Are you willing to collaborate with our underwriters to write business rather than just submitting risks for quoting?

• Is the majority of the business you target eligible for our program?